working capital funding gap calculation

Using working capital calculation can lead to better cash-flow management. Going back to basics we define working capital as the funds invested in.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Here the working capital calculation considers.

. A working capital formula determines the financial health of the. Ad Working capital supply chain finance advice from leading industry experts. Contact A Professional Today.

10000 Monthly Deposits Into Business Bank Account. Link between the internal company documents in 3a and the data reported in the excel template. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625.

The days working capital is calculated by 200000 or working capital x 365 10000000. Which causes a gap in cash flow. However if the company made 12 million in.

Ad Loan Options Available From A Nationally Ranked SBA Lender. Get the most value from your working capital in uncertain times. Compare up to 5 Loans Without a Hard Credit Pull.

Permanent working capital Working capital funding 20000 Finance cost 7 x 20000 1400 Temporary working capital Average working capital funding 25000 2. Ad Funding Up to 500K For Your Business. Get the most value from your working capital in uncertain times.

Ad Compare Top 7 Working Capital Lenders of 2022. Only pay loan fees on the capital you use. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by.

In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities. Ad Give your organization a new framework to optimize working capital and digitize payments. WACC used to calculate the funding gap.

To calculate the working capital needs one needs to use the following formula. Published on January 7 2017 January 7 2017 3 Likes 0 Comments. We need to calculate Working Capital using Formula ie.

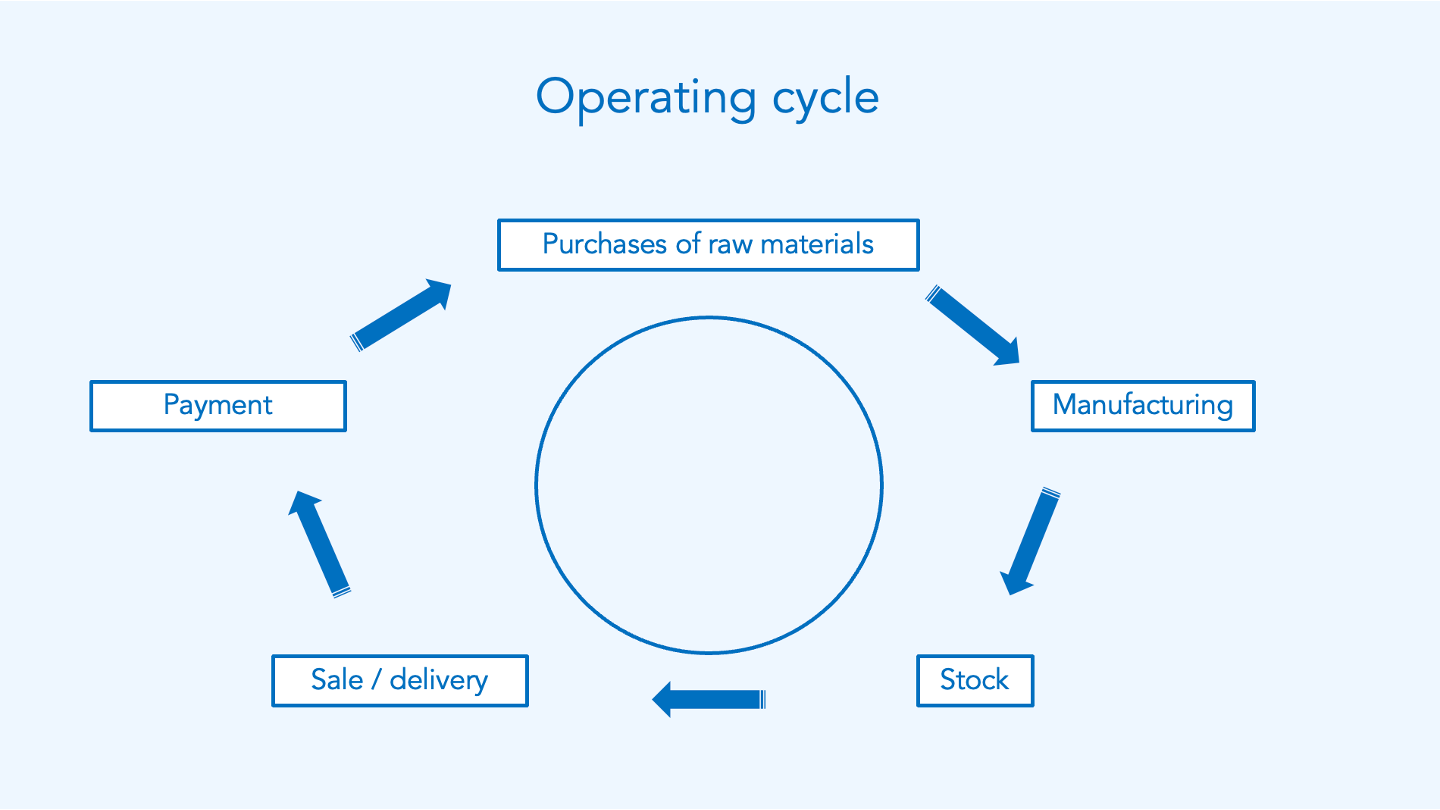

If however the business chooses to use long term finance this flexibility is. Apply Now Get Low Rates. The operating cycle analyzes the accounts receivable inventory and accounts.

Working capital is a key indicator of the financial health of a company. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Ad Apply if approved have access to funding thats there for your business.

The working capital requirement to fund accounts receivable is given as follows. Your Working capital funding gap in days images are ready in this website. The company must elaborate on how to translate.

Working Capital Current Assets Current Liabilities. Working Capital How to calculate and fill cash flow gap. It can also be described.

Ad Get Working Capital Funding Fast. Ad Give your organization a new framework to optimize working capital and digitize payments. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank.

Working capital funding gap in days are a topic that is being searched for and liked by netizens today. A more useful tool for determining your working capital needs is the operating cycle. Net working Capital Current Assets Current Liabilities.

Equation for calculate funding gap is Funding Gap Adequacy Goal - Current Spending. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. This is a straightforward calculation.

Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. See why working capital management is no longer only a treasury function. If it has to pay 8 on.

The first part of working capital analysis is to examine the timelines within which current liabilities are due for payment. The company has revenues of 2 million a day. Find Out How Much Your Business Could Actually Receive As A Working Capital Loan.

And generally speaking the CFO CEO and investors will want the business to operate with positive. Your current ratio will give you an idea if you have enough working. The working capital financing can come in the form of cash from the business itself an operating loan that is connected to the business bank account and goes up and down as required.

Days working capital 73 days. Working Capital Gap. Build Expand Your Company with Customized Small Business Solutions at MT.

Take the complement of the gross marginthe cost of goods soldin this case 100 2 40 or 60. Ad Up to 250k in 24 Hours For All Levels Of Credit Based On Cash Flow. Go to the LendingTree Official Site Get Offers.

Negative working capital is seen any time the net working. The so called Working Capital ratio current ratio is calculated as current assets divided by current liabilities. This can most easily be discerned by examining an aged.

Working Capital Financing What It Is And How To Get It

Methods For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Capital Employed Accounting And Finance Financial Management Bookkeeping And Accounting

Capital Employed Accounting And Finance Financial Management Bookkeeping And Accounting

Working Capital Requirement Wcr Agicap

Leased Asset Types Accounting Treatment And More Accounting Accounting And Finance Accounting Student

Personal Line Of Credit Meaning How It Works Benefits And Drawbacks In 2022 Personal Line Of Credit Line Of Credit Types Of Loans

How To Calculate Working Capital Requirement Plan Projections

Working Capital Requirement Wcr Agicap

Working Capital Formula Youtube

Working Capital Cycle Understanding The Working Capital Cycle

Capital Expenditure Accounting Capital Expenditure Accounting Cash Flow Statement

Secured Vs Unsecured Bonds All You Need To Know Financial Management Good Credit Bond

Leased Asset Types Accounting Treatment And More Accounting Accounting And Finance Accounting Student

Working Capital Cycle Definition How To Calculate

Personal Line Of Credit Meaning How It Works Benefits And Drawbacks In 2022 Personal Line Of Credit Line Of Credit Types Of Loans

Advantages And Application Of Ratio Analysis Analysis Financial Analysis Financial Health

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)