iowa inheritance tax return schedules

Submitted with the Iowa return. Property passing to parents grandparents great-grandparents and other lineal ascendants is exempt from inheritance tax.

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

The following Inheritance Tax rates will apply to a decedents beneficiary who is a.

. Track or File Rent Reimbursement. Change or Cancel a Permit. Schedule B beneficiaries include siblings half.

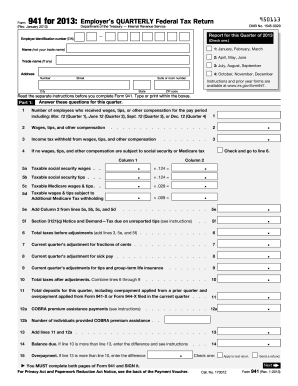

Inheritance Tax Rates Schedule. Learn About Sales. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return.

The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. The Departments inheritance tax return and the liabilities Schedules J and K will be accepted. Read more about IA 706 Inheritance Tax Return Instructions.

IA 706 Inheritance Tax Return Instructions 60-066. A bigger difference between the two states is how the exemptions to the tax work. Iowa Inheritance Tax Schedule J 60-084.

IA 1120F Franchise Return for Financial Institutions Franchise IA 1120F Franchise Estimated Worksheet. Read more about Inheritance Tax Rates Schedule. Brother sister son-in-law daughter-in-law of the decedent.

What is the federal inheritance tax rate for. Iowa Inheritance Tax Schedules. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent.

Iowa InheritanceEstate Tax Return IA 706 Step 1. When Iowa schedules are filed with the return only those schedules that apply to the particular assets and liabilities of the estate are required. For estates of decedents dying on or after July 1 1983 the preliminary inheritance tax return is abolished and a single.

An extension of time to file the return and. If the net value of the decedents estate is less than 25000 then no tax is applied. Stay informed subscribe to receive updates.

To pay inheritance and estate tax in the state of Iowa file a form IA 706. Learn About Property Tax. Dup 219 gdb put learn about sales use tax.

If the federal estate tax return includes the schedules of assets and liabilities the taxpayer may omit Iowa Schedules A through I from the return. There are a number of categories. Register for a Permit.

0-12500 has an Iowa inheritance tax rate. Fiduciary IA 1041 Schedule I Iowa Alternative Minimum Tax Franchise. An extension of time to file the return and.

Iowa Inheritance and Gift Tax. If the deceased persons net estate discussed below is worth 25000 or less no. 4504 additionally no inheritance tax return is required.

A summary of the different categories is as follows. Property passing to children biological and legally-adopted. This document is found on the website of the government of Iowa.

Iowa Inheritance Tax Return Schedules. Estates of decedents dying on or after July 1 1983. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent.

While the top estate tax rate is 40 the average tax rate paid is just 17. Iowa Schedules A through I. That is worse than Iowas top inheritance tax rate of 15.

Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance.

Form Ia 706 Ia 706 Tax Return Only

What Are Inheritance Taxes Turbotax Tax Tips Videos

How Much Is Inheritance Tax Community Tax

State Tax Deadlines Extended Amid Covid 19 Outbreak Radio Iowa

What Is Inheritance Tax Probate Advance

What Is The Difference Between Estate Tax And Inheritance Tax 5 Smart Tips

Appliction For Refund Of Inheritance Or Estate Tax Rev 1313 Pdf Fpdf Docx

Michigan Inheritance Tax Explained Rochester Law Center

Death And Taxes Nebraska S Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Do I Have To Pay Taxes When I Inherit Money

Tennessee Short Form Inheritance Tax Form 2000 Fill Out Sign Online Dochub

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Form Schedule F Inheritance Tax Rate Schedule Schedule F

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

Iowa Inheritance Tax Law Explained Youtube

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller